| Want to send this page or a link to a friend? Click on mail at the top of this window. |

More Special Reports |

| Posted February 5, 2008 |

| ECONOMY FITFUL, AMERICANS |

| START TO PAY AS THEY GO |

____________ |

|

LIVING WITHIN MEANS |

|

____________ |

|

Easy Credit Era Over, |

|

Some See a Trend |

|

Back to Thrift |

|

____________ |

|

By PETER S. GOODMAN |

For more than half a century, Americans have proved staggeringly resourceful at finding new ways to spend money.

In the 1950s and ’60s, as credit cards grew in popularity, many began dining out when the mood struck or buying new television sets on the installment plan rather than waiting for payday. By the 1980s, millions of Americans were entrusting their savings to the booming stock market, using the winnings to spend in excess of their income. Millions more exuberantly borrowed against the value of their homes.

|

But now the freewheeling days of credit and risk may have run their course — at least for a while and perhaps much longer — as a period of involuntary thrift unfolds in many households. With the number of jobs shrinking, housing prices falling and debt levels swelling, the same nation that pioneered the no-money-down mortgage suddenly confronts an unfamiliar imperative: more Americans must live within their means.

“We don’t use our credit cards anymore,” said Lisa Merhaut, a professional at a telecommunications company who lives in Leesburg, Va., and whose family last year ran up credit card debt it could not handle.

Today, Ms. Merhaut, 44, manages her money the way her father did. Despite a household income reaching six figures, she uses cash for every purchase. “What we have is what we have,” Ms. Merhaut said. “We have to rely on the money that we’re bringing in.”

The shift under way feels to some analysts like a cultural inflection point, one with huge implications for an economy driven overwhelmingly by consumer spending.

While some experts question whether most Americans, particularly baby boomers, will ever give up their buy-now/pay-later way of life, the unraveling of the real estate market appears to have left millions of families with little choice, yanking fresh credit from their grasp.

“The long collapse in the United States savings rate is over,” said Ethan S. Harris, chief United States economist for Lehman Brothers. “People are going to start saving the old-fashioned way, rather than letting the stock market and rising home values do it for them.”

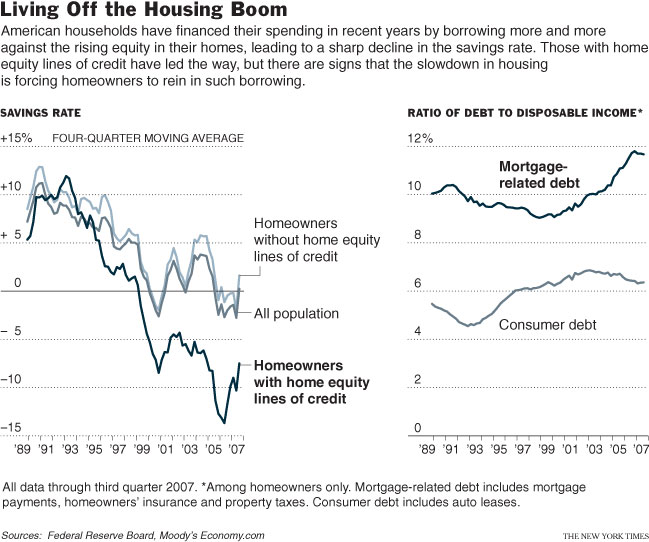

In 1984, Americans were still saving more than one-tenth of their income, according to the government. A decade later, the rate was down by half. Now, the savings rate is slightly negative, suggesting that on average Americans spend more than their disposable income.

Though the savings rate does not account for the increased value of stock and property, or the gains on retirement accounts, many economists still view it as the most useful gauge of the degree to which Americans are making provisions for the future.

For the 34 million households who took money out of their homes over the last four years by refinancing or borrowing against their equity — roughly one-third of the nation — the savings rate was running at a negative 13 percent in the middle of 2006, according to Moody’s Economy.com. That means they were borrowing heavily against their assets to finance their day-to-day lives.

By late last year, the savings rate for this group had improved, but just to negative 7 percent and mostly because tightened standards made loans harder to get.

“For them, that game is over,” said Mark Zandi, chief economist at Economy.com. “They have been spending well beyond their incomes, and now they are seeing the limits of credit.”

Many times before, of course, Americans have found innovative ways to finance spending, even when austerity seemed unavoidable. It could happen again.

The Me Decade was declared dead in the recession of the early 1980s, only to yield to the Age of Greed and later the Internet boom of the 1990s. Over the longer term, the economy should keep growing at a pace that reflects improving productivity and population gains.

But for the first time in decades, credit is especially tight as the bursting of the housing bubble has spread misery across the financial system. In homes now saturated with debt, conspicuous consumption and creative financing have come to seem a sign of excess not unlike that of a suntan in an age of skin cancer.

The return to reality is on vivid display at shopping centers, where consumers used to trading up to higher-price stores are now heading to discounters. Wal-Mart and T. J. Maxx are thriving, but business has slowed at Coach, Tiffany and Williams-Sonoma.

Not long ago, Elena Gamble would have looked at the Cadillac parked across the street from her modest home in Elk City, Okla., and felt a twinge of jealousy.

“We live in a small town, and everybody looks at your clothes and what you drive and where you have your hair done,” said Ms. Gamble, who earns about $2,600 a month as a grievance counselor at a local prison.

Now, she and her husband — a prison guard who brings home $2,000 a month — are grappling with $10,000 in high-interest debt. They no longer go to the movies or out to eat, except occasionally to McDonald’s. They quit their Internet service. Their car was repossessed.

“What we say now is, ‘If we can’t afford it, we can’t buy it,’ ” Ms. Gamble said. And when she looks across the street at that Cadillac, her envy has been replaced by pity for the neighbor on the hook.

“I say, ‘Oh my, you’re living here, and driving that? There’s got to be something wrong,’ ” Ms. Gamble said. “ ‘You’re in debt, and you’re in trouble.’

"For decades, that envy has been a prime engine of economic growth. Debt-willing consumers hungering for the latest-generation this and the fastest that kept factories busy from Michigan to Malaysia.

From 1980 to 2007, consumer spending swelled from 63 percent of the economy to over 70 percent, according to Economy.com, while the share of after-tax income absorbed by household debt increased from 11 percent to more than 14 percent.

During the technology boom of the 1990s, an extravagant mind-set took hold. In ads for the discount broker Ameritrade, a spiky-haired hipster ridiculed middle-aged professionals for settling for conventional returns.

Even after the “stock market as money machine” line of thinking proved bogus, extra spending continued. The Federal Reserve cut interest rates to near record lows, banks marketed mortgages with exotically lenient terms and another fable of wealth creation took hold: the notion that housing prices could go up forever.

The come-ons for stocks were replaced by a new crop of advertisements. A house was no longer a mere place to live; it was a checkbook that never required a deposit. Between 2004 and 2006, Americans pulled more than $800 billion a year from their homes via sales, cash-out mortgages and home equity loans.

“People have come to view credit as savings,” said Michelle Jones, a vice president at the Consumer Credit Counseling Service of Greater Atlanta.

Some Americans have so much wealth that they can spend enough to fuel much of the economy. The top fifth of American earners generates half of all consumer spending, noted Dean Maki, chief United States economist at Barclays Capital.

For the others, some say credit is an intrinsic part of modern life, and Americans will soon be back for more. “A river of red ink runs through the history of the American pocketbook,” said Lendol Calder, author of “Financing the American Dream: A Cultural History of Consumer Credit.”

“Partly because of desire, partly because of optimism, partly because lenders have been free to invent useful borrowing tools that minimized shame and bother,” he added, “I think it will take a great catastrophe, greater than the Great Depression, to wean Americans from their reliance on consumer credit.”

Credit counselors are now swamped by calls not just from people of modest means, but from professionals earning six-figure incomes, their access to finance warping their distinction between necessity and desire.

“The longer someone has lived on a high income, the harder it is for someone to cut back,” said Manuel Navarro of Money Management International in San Diego. “I ask them, ‘Do you really need to have a 60-inch flat-screen TV hanging on your wall?’ ”

Fran Barbaro has an M.B.A. and a résumé of computer industry jobs with salaries reaching $150,000 a year. She used to have a stock portfolio worth about $1 million. She hung original art on the walls of her three-bedroom house in Boston.

But divorce, illness and motherhood drained her savings. Her home is worth less than she owes, and she owes another $200,000 to credit card companies, banks and tax collectors.

Ms. Barbaro, 50, said she knew she was living beyond her means. But her house demanded work. Her two boys needed after-school programs running $25,000 a year. Medical bills multiplied.

“These were simple day-to-day expenses,” she said. “The money was always there.”

Until it wasn’t. Her take-home pay is $5,200 a month, but her debt payments reach $4,400.

Ms. Barbaro has rented out her house while negotiating to lower her mortgage. She has moved to an apartment, where her sons sleep in the lone bedroom while she sleeps on a pull-out sofa.

“It’s the worst,” Ms. Barbaro said. “How do you salvage what you have and hopefully go back?”

Michael Barbaro contributed reporting.

Copyright 2008 The New York Times Company. Reprinted from The New York Times, National, of Tuesday, February 5, 2008.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |